Finance minister Robert C McLeod has tabled a review of revenue options available to the GNWT in response to the harsh economic climate.

The review, tabled Tuesday, considers the feasibility of raising additional revenues to help fund rising government expenditures.

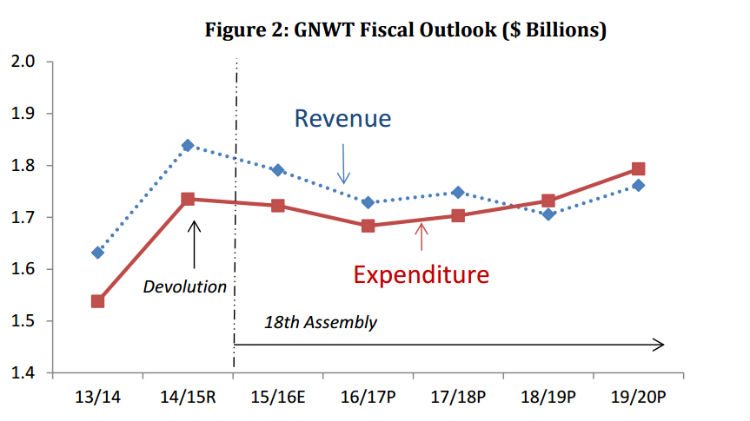

Currently, the GNWT is on an unsustainable fiscal path as revenues decline and expenditure pressures continue to mount.

According to McLeod, some revenue sources to consider include taxes on residents and businesses, taxes on goods such as fuel and tobacco or even liquor markups.

“Increasing GNWT revenues can help us partially address the growing gap between government expenditures and the money we are bringing in,” said McLeod in a statement.

But as MLAs weigh options available to them, McLeod says the 18th Assembly will have to be mindful of the impact any decisions will have on taxpayers.

Small tax bases also limit the amount that can be raised through increased taxation.

“While we can increase own-source revenues by raising taxes, fees and resource revenues, we have to be careful that the choices we make do not raise the cost of living for Northerners, discourage investment or shrink the NWT economy,” added McLeod.

Recently, the government has shown signs of belt-tightening by freezing the salaries of deputy ministers, senior managers and excluded employees for the next two years.

MLAs followed suit by voting to ice their own salaries Tuesday.

But to fully address the projected gap between what’s coming in and what’s going out, the GNWT says it will need to come up with $150 million in combined revenue and expenditure measures over the next five years.

Its ability to do so may be hindered however, since the government says it can’t raise enough own-source revenues to address the problem.

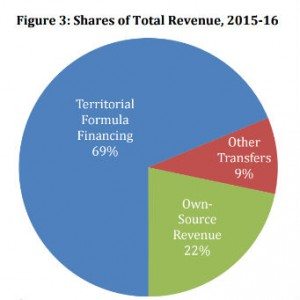

Presently, revenues generated within the NWT account for 22 percent of total revenues while the majority of government revenues – 69 percent – come from federal transfer payments.

Own-source revenues like corporate income tax and resource revenues can also be volatile from one year to the next.

This puts MLAs in a tough position, since the government needs to drum up more revenues but measures like tax hikes might not make much of a difference.

There’s also fear that increased taxation might cause revenue decline, especially if it results in a slowdown of economic activity and causes people to leave the territory.

Read: Feds Restore $67M Cut From Territorial Transfer Payments

Read: Bargaining Begins Between GNWT And Workers’ Union

McLeod’s report makes it clear that government revenues are only half of the equation.

While they have a place in addressing the territory’s fiscal needs, the government will also need to make some key decisions when it comes to expenditures.

“While the GNWT’s fiscal strategy will include looking at tax options, the solution to the fiscal situation will not be realized solely by increasing taxes on NWT residents and businesses,” the report states.

“The few revenue options that could generate significant revenues would discourage business investment and economic growth, and would leave individuals and families with less disposable income at a time when the costs of living are rising.”

As the 18th Assembly weighs options available to it, the report says members must consider the economic impact and timeliness of their decisions.